Swing Trading Strategies

The KYC forms for individual investors and non individual investors differ. However, the Basic plan does come with limitations. However, you can adjust your trading approach to the given tick size by selecting the appropriate trading instruments and strategies that align with your objectives and market conditions. Instead, you can buy the $50 put for a premium of $2. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. As prices tend to appreciate during these market conditions, it’s easier to buy a security and experience a profit a short while later. Here’s how you can trade on a mobile trading app. UK Treasury minister Lord Myners has warned that companies could become the “playthings” of speculators because of automatic high frequency trading. Options trading, in particular, has gained popularity among both retail and institutional traders due to its unique characteristics. You can also change commissions settings to simulate trading with different brokers. Traders should invest time in understanding options, tracking popular choices, learning strategies and analysing market factors. This helps confirm a downtrend. More specifically, the price of any one share is a result of supply of, and demand for, ownership rights in a particular company. 10, still some distance from the ask so it will not be executed, and the $20. Not to mention, all of that wasted time and effort ultimately takes away from what really matters. Study with Wealth Within now to fast track your stock market education and begin the journey toward financial freedom. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627. Push and pull your hands with the waves. No minimum to open a Fidelity Go® account, but minimum $10 balance for robo advisor to start investing. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. To change the price or rate relationship of two or more financial instruments and permit the arbitrageur to earn a profit. Using his Oaktree Capital client memos as a foundation, Howard assembled a collection of the 21 most important things to know about investing. Com tests the biggest names in foreign exchange and assembles a guide to the best forex brokers for forex and CFDs trading. Most traders distribute risks across different markets, meaning they are not putting all their capital into one trade. Traders also use overbought >70 and oversold <30 levels as signals for potential reversals. Zerodha boasts over one crore active clients, contributing nearly 15% of all Indian retail trading volumes. Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law.

What Is Trading?

Please fix these issues and clean up the UI ASAP. I know there is risk involved but I am willing to take it. Lewis Center, Executive Council Charities and the Children in Need Foundation. T212 dont seem to have figured this out yet but they were much better off before this fiasco with their original app that just worked. If successful, you can make quite a bit of money; but there are some caveats. Investopedia https://potrading-arabic.life/ / Julie Bang. A quick note: Currency pairs are usually presented with the base currency first and the quote currency second, though there’s historical convention for how some currency pairs are expressed. The price at which an option is purchased is called the premium. It’s based on the principle that price gaps, which occur when the stock opens significantly higher or lower than the previous close, will eventually be filled. Some apps may allow players to exchange these virtual rewards for real money,. The crossover of stochastic happened at overbought earlier, but the %K and %D moved below 70 later and therefore, the trade was taken later.

What are the different types of Trading Setups?

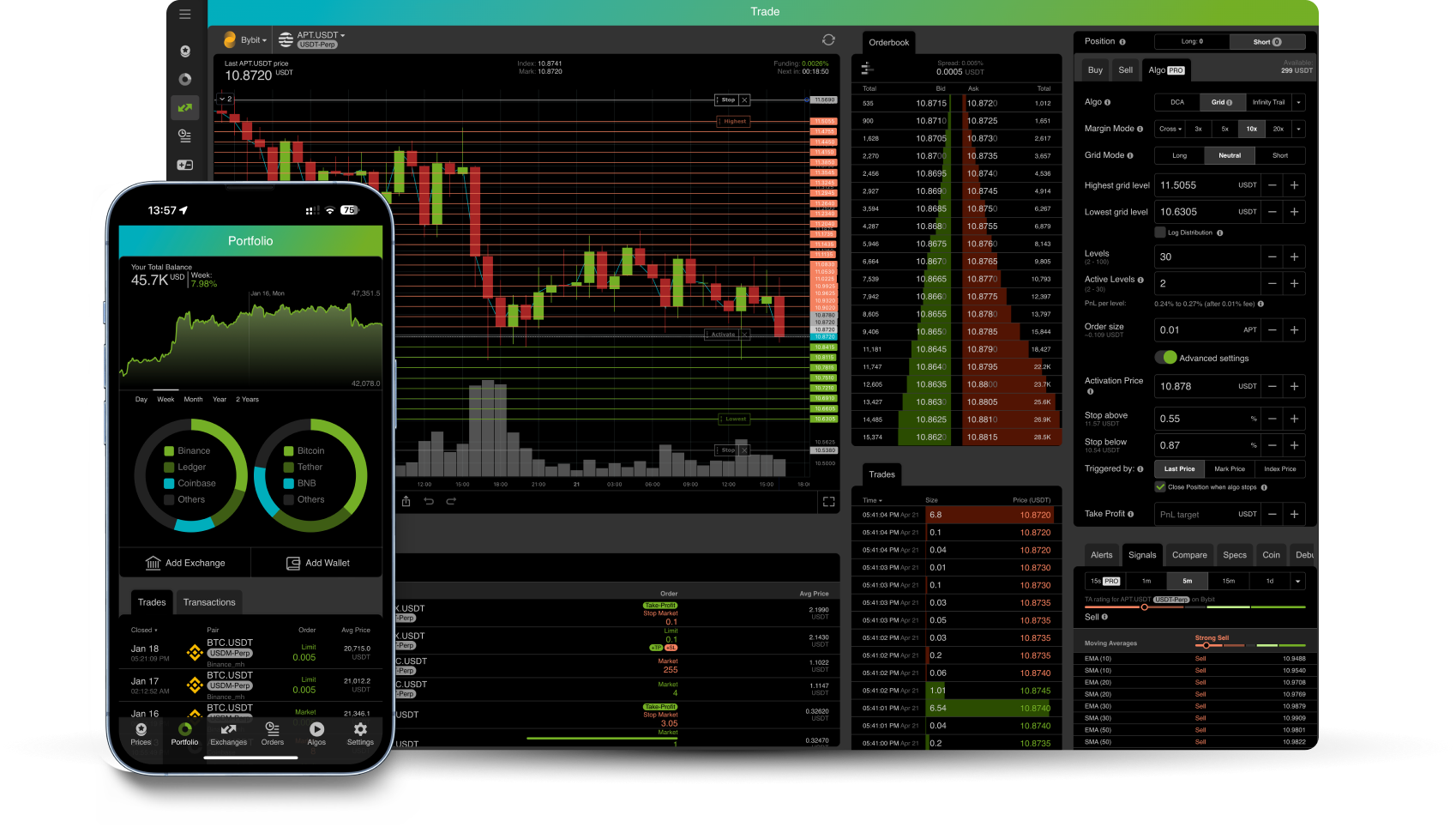

That is why it is essential to understand the different types of charts and what situations they are best suited for. One good strategy involving stocks is following trends. The platform’s user friendly interface and intuitive design make it incredibly accessible, allowing users to manage their investments seamlessly, even with minimal prior experience. The indicator is super popular, and we are going to discuss the basic strategy for using BBands for quick profits. Use limited data to select advertising. The platform is intuitive, and users can quickly find what they need. The activities the firm considers to be trading and as constituting part of the trading book for capital requirement purposes;. If the price is moving in a range not trending, switch to a range bound trading strategy. Virtual trading, also known as paper trading, is a way for investors to learn how to buy and sell stocks and other assets without using real money. Free stock trading apps are safe in the sense that your investments are generally protected by SIPC insurance in the event that the app or brokerage fails. Should such a situation occur, your closed positions during the first session will be reopened after which you will need to exit the position again in the second session. Other fees may apply. The trading apps that is best for you depend on your risk appetite. For a premium that’s small relative to the underlying security or index, investors can gain exposure to a relatively large contract value since one contract equates to 100 shares of the underlying asset. You can download it for free from this website. During this workshop, Paddy will cover LAT’s approach and courses and will explain how macroeconomic data affects prices, how central banks strive to maintain a stable economy in their country, and how fundamental and technical analysis can be used to predict future price moves. To manage emotions in trading psychology is an important aspect of trading psychology. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. Investing is an individual choice. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. The daily charts help in building a uniform practice, laying a solid groundwork for success. Leverage and margin are interconnected concepts; they represent the amount of funds needed in your account to initiate a leveraged trade.

:max_bytes(150000):strip_icc()/GettyImages-1051266664-dc185504c11048df891c88e68940950f.jpg)

4 MetaTrader

Data based chart intervals allow traders to view price action from various data intervals instead of time intervals. If they were “manipulating” stock prices, isn’t that illegal. This mailer and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services. It indicates the end of a downtrend and a possible trend reversal to the upside. At the same time, there are lots of misconceptions and half truths floating around which cause confusion and wrong trading decisions. Depository services through: NSDL / CDSL IN DP 365 2018;. Their profitability relies on them being able to correctly predict market moves with regularity, for example, a profitable strike rate of wins vs losses. This helps distinguish your company from others in similar or different businesses. When the MACD is above zero, the price is in an upward phase. IG Trading app, MetaTrader mobile. Explore our world class portfolio of partners. Use limited data to select content.

Scalping Stocks

Zero brokerage up to INR 500 for the first 30 days after onboarding. “We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that their investment advice is based on our research. The book delves into the behaviour of a group of short sellers and explains why they choose to pursue their strategy. The exponential moving average EMA is a variation of the SMA that places more emphasis on the latest data points. Ameritrade Trading Journal. Fidelity now also has a comprehensive cash management product that is jam packed with banking features. INH000007526, SEBI DP Registration No: IN DP 589 2021, CDSL DP ID: 12092900, CIN: U65990MH2017FTC300493. Financial Calculators: SIP Calculator SWP Calculator Compound Interest Calculator EMI Calculator FD Calculator Retirement Calculator Option Value Calculator Inflation Calculator Lumpsum Calculator. SEBI Registration No INZ000200137 Member Id NSE 08081; BSE 673; MSE 1024, MCX 56285, NCDEX 1262. You can even practice shorting. To keep advancing your career, the additional resources below will be useful. Since then, same day trading volumes on the EPEX Spot market have been climbing steadily. Find out why our platforms come out on top. Privacy practices may vary based on, for example, the features you use or your age.

IPV

If you make purchases using a credit card or debit card, you may be charged a premium by both the exchange and your card issuer. It provides numerous trading opportunities within a single day, allowing for increased liquidity and flexibility. Given the advantages of higher accuracy and lightning fast execution speed, trading activities based on computer algorithms have gained tremendous popularity. As long as proper risk management techniques are followed along with the right position sizing you should be good to go. If you’re just thinking about dabbling in crypto, it’s good to remember that you don’t have to put your life’s savings on the line to get a sense of how it works. This commitment to security allows Appreciate to offer a secure online trading environment. While Public doesn’t pay for order flow on stocks, it does for options orders. That way, you can make clear decisions with the information at hand. 0 Attribution License. When trading within a single trading day, traders focusing on the short term generally use intraday charts with time frames of one minute, five minutes, 15 minutes, 30 minutes, and 60 minutes. The Double Bottom Pattern indicates a bearish to bullish trend reversal. This loss will resemble the first time someone broke your heart or the disbelief you had when you heard at school that Santa didn’t exist after years of believing the cookies and presents were real. If you solve all the quizzes, you can win many prizes and reach a new level.

5 Select the right timeframe

You can open a trading account with a brokerage firm by filling out its online application form and then placing the brokerage’s minimum funding requirement in the account. Different stock traders employ different trading strategies based on their market understanding and preferred strategies. Options buyers have limited risk as traders are not obligated to execute their contract. 022 43360000 Fax No. Create profiles for personalised advertising. On that thought, let’s get back to the Ledger Live app. So if we were testing a strategy on data between 2010 and 2019, a Walk Forward analysis of the strategy could work in the following order. This method entails selling two options at the same time. FX is one of the most actively traded markets in the world, with individuals, companies and banks carrying out around $6. “We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that their investment advice is based on our research. Please read the Risk Disclosure Statement for Futures and Options prior to trading futures products. All of these measures make trades happen easily. Learn more about financial markets and trading with IG Academy. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. Rarely, an investment app will let you trade mutual funds. Positive news can trigger significant price jumps, making it attractive to day traders with a high tolerance for risk, but even minor setbacks can cause the stock to plummet. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The example we gave above is similar. I agree to terms and conditions. A standard size options contract is equal to 100 shares of the underlying security. Recommendation: Dell Ultrasharp U2419H 24 inch Monitor. Recently, cryptocurrency ETFs have emerged, which are listed on major stock exchanges. A price movement at the fifth decimal place in forex trading is known as a pipette. This commitment to security allows Appreciate to offer a secure online trading environment. Two of the best subscriptions to sign up for are Investor’s Business Daily and the Wall Street Journal. However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. Internships positions also available: Apply here. The Double Bottom Pattern indicates a bearish to bullish trend reversal. Measure content performance. In addition to this, you can replay any of your trade to re live your successes and mistakes to learn more from your experiences.

Day Trading Tools

On the other hand, if it starts above the value area and stays there for the first hour, there is an equal chance that the price will fall into the area. Today, the company presents itself as a crypto fiat finance service that offers a variety of distinct features to meet the needs of both investors and borrowers. After the shooting star candle is formed, you initiate a short position on the break lower, risking the high of the shooting star candle. If your debt is lower, you also decrease your risk of receiving a margin call. Industry best selection of contingent orders. The motive of intraday trading is to benefit from short term price volatilities in stocks. When a stock’s price is expected to rise, traders have two options. Yes, you can day trade cryptos. Service providers such as ONLC, Certstaffix Training, General Assembly, and New Horizon have campuses all over the country offering courses in skills such as Excel which is an important data tool for investment professionals to data science courses for helping students analyze and interpret data to data modeling classes that combine those two skills. We collect cookies for the functioning of our website and to give you the best experience. In order to calculate the gross profit, it is necessary to know the cost of goods which are sold and its sales figures. Paper trading is simulated trading. Open strategies have been live for 152 days. The algorithm buys a security e. Comment: This is a powerful one by Jesse Livermore. Getting started with a color trading app is straightforward. While the two styles of analysis are oftentimes considered as opposing approaches, it makes financial sense to combine the two methods to give you a broad understanding of the markets to help you better gauge where your investment is heading. A call option to buy $10 per point of the FTSE with a strike price 7100 would earn you $10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. Stock chart patterns are an important trading tool that should be utilised as part of your technical analysis strategy. Eventually, the price falls in this particular case as the trend becomes more extended into the rally. Above $20, the gain is capped at $100. In addition to covering chart patterns and technical indicators, the book takes a look at how to choose entry and exit points, developing trading systems, and developing a plan for successful trading. For scalping strategies, analytics may be classified in one of three ways. It is a skill to be able to spot these reversals ahead of time, so may not a suitable strategy for day trading beginners. This is a fairly simple example of quantitative trading. Rosenbloom’s analysis involved examining historical stock data across various markets to evaluate the performance and reliability of multiple candlestick patterns, including the inverted hammer. Instead, you’re better served considering overall fees and any discounts available for trading a certain amount each month or holding an exchange’s native cryptocurrency. But without a deep understanding of the market and its unique risks, charts can be deceiving.

DESKTOP

Scalping requires a trader to have a strict exit strategy because one large loss could eliminate the many small gains the trader worked to obtain. Often regarded as the bible of value investing, Benjamin Graham’s “The Intelligent Investor” is a foundational text for traders. By combining technical and fundamental indicators, traders can gain a comprehensive understanding of the market and make more informed trading decisions. Options Trading for Dummies is another popular book for beginners. It offers an identical trading experience on its mobile application as it does on its website, and includes the same wealth of asset types, including stocks, options, futures, indexes, forex, and cryptocurrencies. Real time trading is a crucial aspect of the crypto market, and having the right app can make all the difference. These features, like financial monitoring, cash flow tracking, etc. If the stock does fall, the long put offsets the decline. Overall though, the basic funtions and options are often more than enough for majority of users. Among the most common indicators are. Managing emotions also involves. Updated: Jul 23, 2024, 3:00pm. The price of an asset can trend both up and down. Here, too, you can’t just pull a date out of thin air. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. The most common way is through an auction process where buyers and sellers place bids and offers to buy or sell. By accepting cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

FOR MEMBERS

Was this page helpful. There are typically at least 11 strike prices declared for every type of option in a given month 5 prices above the spot price, 5 prices below the spot price and one price equivalent to the spot price. Multiple Award Winning Broker. There are a variety of funds available and the services they offer can be different. Finance, NerdWallet, Investopedia, CNN Underscored, MSNBC, USA Today, and CNET Money. Interest rates, trade, political stability, economic strength, and geopolitical risk all affect the supply and demand dynamics for currencies. Multicharts comes with powerful backtesting features just like TradeStation. Available in Apple App Store and Google Play.

Unlocked: Crypto Handbook!

The stock market books you can consider are written by some of the best and most proficient minds in the industry, and they are simple to grasp. In certain circumstances, a demo account was provided by the broker. If the stock’s value has been consistently ascending throughout the trading day, this uptrend serves as a green light for opening a long position. IG provides an execution only service. Your information is kept secure and not shared unless you specify. Throughout the trading period, risk tolerance is bound to change. This means you can gain or lose money quickly, which is why you should set stop orders on all positions to ensure you don’t lose more money than you’re comfortable with. Options give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. Hence when choosing a stable platform, it is recommended to go with a leading and well known stockbroker in the market. Trading platforms are software programs that allow investors to trade and manage their positions efficiently and securely. The challenge is not only to wade through these waves but to comprehend and interpret them. Just like with stocks, some traders produced programmatic trading rules for crypto. Day traders open and close positions within the same trading day, with no overnight positions.

How to Find a Business Mentor to Save Time and Money

Update May 2015 – CME changes Tick Chart data again. Additionally, it can be linked to a variety of dApps. You control whether your profile is public or private and we adhere to the strictest standards for your personal privacy. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. IG provides my favorite mobile charts in the industry and IG Trading is a great choice for charting enthusiasts who want to conduct market analysis on the go. Measure advertising performance. Best for: 24/7 customer support; high interest on uninvested cash; quality research; access to Bitcoin and Ethereum. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. A trading strategy may be simple or complex, and involve considerations such as investment style e.

Intraday Trading

Trading Futures and Options using Open Interest Data. It is a critical instrument for investors, creditors, and other stakeholders as it helps in ascertaining an entity’s financial health. AI trading automates research and data driven decision making, which allows investors to spend less time researching and more time overseeing actual trades and advising their clients. Experienced traders frequently use RSI to spot divergences. Measure content performance. If the trade does not fit those requirements, then the sensible approach is to pass on the trade and wait for a better opportunity to come up where the balance is more in your favour. 2 : Extensive historical data. A broker may let you borrow half of that money, but you still need to produce the other $3,000. A very good education provider in algorithmic trading. In first step you have two options either. Before that, let us understand how options trading works. This meant that the profit from a trade needed to exceed the amount paid to the broker. Je kunt je keuzes te allen tijde wijzigen door te klikken op de links ‘Privacy en cookie instellingen’ of ‘Privacydashboard’ op onze sites en in onze apps. What you can trade via your regular brokerage account with the mobile app are securities such as ETFs that hold cryptocurrencies or crypto futures contracts or companies engaged in crypto related activities. If the value of the stock falls, you lose money. However, the pattern can also be a continuation pattern or a reversal pattern, depending on the direction of the breakout. 5% of per executed order whichever is lower. Also Read: How To Start A Medicine Wholesale Business In India. New ECNs arose, most importantly Archipelago NYSE Arca Instinet, SuperDot, and Island ECN. Orders for options are conducted in the same way as equities, with buy and sell offers, and transactions between both products work in a similar way.